To convert Trust Wallet funds to your bank account, transfer them to an exchange, sell for fiat, and withdraw to your bank.

Understanding the Conversion Process

What Does Converting Trust Wallet to Bank Account Mean

Converting your Trust Wallet to a bank account means exchanging your cryptocurrency holdings into fiat currency (such as USD, EUR, or GBP) and transferring those funds to your traditional bank account. This process involves several steps, including transferring your crypto assets to a cryptocurrency exchange, selling those assets for fiat currency, and then withdrawing the fiat currency to your bank account.

- Cryptocurrency Exchange: A platform where you can trade cryptocurrencies for fiat currency.

- Fiat Currency: Traditional government-issued currency, such as the US Dollar or Euro.

Why You Might Want to Convert Cryptocurrencies

There are several reasons why you might want to convert your cryptocurrencies to fiat currency and transfer it to your bank account:

- Liquidity Needs: Converting crypto to fiat provides liquidity, allowing you to access funds for everyday expenses or significant purchases.

- Market Volatility: Cryptocurrencies are known for their price volatility. Converting to fiat can help secure profits or minimize losses during market fluctuations.

- Investment Diversification: Converting some of your crypto holdings into fiat can diversify your investment portfolio and reduce risk.

- Regulatory Compliance: Depending on your location, converting crypto to fiat and reporting it may be necessary to comply with tax and regulatory requirements.

- Ease of Use: Fiat currency is widely accepted and can be used for various transactions that might not accept cryptocurrencies.

Choosing a Cryptocurrency Exchange

Selecting a Reputable Exchange

Choosing a reputable cryptocurrency exchange is crucial for ensuring the safety and efficiency of your transactions. Here are some key factors to consider:

- Security Features: Look for exchanges with strong security measures, such as two-factor authentication (2FA), cold storage for funds, and encryption protocols.

- Reputation and Reviews: Research the exchange’s reputation by reading user reviews and checking for any history of security breaches or regulatory issues.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you want to convert.

- Fees and Charges: Compare transaction fees, withdrawal fees, and other charges across different exchanges to find the most cost-effective option.

- Regulatory Compliance: Choose an exchange that complies with local regulations and has proper licensing.

Creating an Account on the Exchange

Once you’ve selected a reputable exchange, follow these steps to create an account:

- Visit the Exchange Website: Navigate to the official website of the exchange you have chosen.

- Sign Up: Click on the sign-up or register button to start the account creation process.

- Enter Personal Information: Provide the required information, such as your name, email address, and password. Use a strong and unique password to enhance security.

- Verify Email Address: After submitting your information, you will receive a verification email. Click the link in the email to verify your address.

- Enable Security Features: Once logged in, enable additional security features like two-factor authentication (2FA) to protect your account.

- Complete KYC Verification: Many exchanges require Know Your Customer (KYC) verification. Submit the necessary documents, such as a government-issued ID and proof of address, to complete the verification process.

- Link Payment Methods: Add and verify your bank account or other payment methods to facilitate fiat withdrawals.

Linking Your Bank Account to the Exchange

Verifying Your Identity

Before you can link your bank account to a cryptocurrency exchange, you must complete identity verification, often known as Know Your Customer (KYC) verification. This process ensures the exchange complies with regulatory requirements and enhances the security of your transactions. Here’s how to do it:

- Provide Personal Information: Enter details such as your full name, date of birth, and residential address.

- Upload Identification Documents: Submit copies of government-issued ID, such as a passport, driver’s license, or national ID card. Some exchanges may also require a selfie with the ID for additional verification.

- Proof of Address: Upload a document that verifies your address, such as a utility bill, bank statement, or lease agreement. Ensure the document is recent, typically within the last three months.

- Wait for Approval: The exchange will review your documents. This process can take from a few hours to several days. You will be notified once your identity is verified.

Adding and Verifying Your Bank Account

Once your identity is verified, you can add and verify your bank account to enable fiat withdrawals. Follow these steps:

- Navigate to the Bank Account Section: Log in to your exchange account and go to the section where you can link your bank account. This is often found under account settings or payment methods.

- Enter Bank Details: Provide your bank account information, including the bank name, account number, and routing number. Ensure that the information matches your verified identity details.

- Initiate a Verification Process: The exchange will typically perform a verification process to confirm your bank account ownership. This may involve:

- Micro-Deposits: The exchange will make small deposits (usually a few cents) into your bank account. You will need to check your bank account, note the exact amounts, and enter them back into the exchange platform to verify the account.

- Document Submission: Some exchanges may require a bank statement or a voided check to verify your bank account.

- Confirmation: Once the verification process is complete, your bank account will be linked to the exchange. You can now transfer fiat currency between your bank account and the exchange.

Transferring Cryptocurrencies to the Exchange

Generating Deposit Addresses

To transfer cryptocurrencies from your Trust Wallet to an exchange, you first need to generate a deposit address on the exchange. Here’s how to do it:

- Log In to Your Exchange Account: Access your account on the chosen cryptocurrency exchange.

- Navigate to Deposit Section: Find the deposit section, which is typically under the “Wallet” or “Funds” menu.

- Select the Cryptocurrency: Choose the specific cryptocurrency you want to deposit. Make sure the selected cryptocurrency matches the one you are transferring from Trust Wallet.

- Generate Deposit Address: The exchange will provide you with a unique deposit address for the selected cryptocurrency. This address can be in the form of a long string of characters or a QR code.

- Copy the Address: Copy the deposit address to your clipboard, ensuring no characters are omitted or altered.

Sending Funds from Trust Wallet to the Exchange

After generating the deposit address, you can send your funds from Trust Wallet to the exchange by following these steps:

- Open Trust Wallet: Launch the Trust Wallet app on your device.

- Select the Cryptocurrency: Tap on the cryptocurrency you want to transfer.

- Tap on Send: Locate and tap the “Send” button within the wallet interface.

- Enter the Deposit Address: Paste the deposit address copied from the exchange into the recipient address field in Trust Wallet.

- Specify the Amount: Enter the amount of cryptocurrency you wish to transfer. Ensure you leave enough funds in your wallet to cover transaction fees.

- Review Transaction Details: Double-check the recipient address and the amount to be transferred to avoid any errors.

- Confirm and Send: Tap “Next” or “Confirm” to initiate the transfer. You may need to enter your wallet password or use biometric authentication to complete the transaction.

- Wait for Confirmation: Blockchain transactions require network confirmations. The time taken can vary depending on the cryptocurrency and network congestion. You can monitor the transaction status in Trust Wallet and the exchange’s deposit history.

Selling Cryptocurrencies for Fiat

Placing a Sell Order

To sell your cryptocurrencies for fiat currency on an exchange, follow these steps:

- Log In to Your Exchange Account: Access your account on the cryptocurrency exchange where you have deposited your funds.

- Navigate to the Trading Section: Go to the trading or exchange section, often labeled as “Trade,” “Markets,” or “Exchange.”

- Select the Trading Pair: Choose the trading pair that matches your cryptocurrency and the fiat currency you want. For example, if you are selling Bitcoin for USD, select the BTC/USD trading pair.

- Choose the Type of Sell Order: There are typically several types of sell orders you can place:

- Market Order: Sells your cryptocurrency at the current market price. This is the fastest and most straightforward option.

- Limit Order: Allows you to specify the price at which you want to sell your cryptocurrency. The order will only execute when the market reaches your specified price.

- Enter the Amount: Specify the amount of cryptocurrency you want to sell. For limit orders, also specify the price at which you want to sell.

- Review the Details: Double-check all the details of your sell order, including the amount and price.

- Place the Order: Confirm and place your sell order. For market orders, the sale will typically execute immediately. For limit orders, you will need to wait until the market reaches your specified price.

Understanding Transaction Fees and Limits

When selling cryptocurrencies for fiat, it’s important to understand the transaction fees and limits involved:

- Transaction Fees: Most exchanges charge a fee for executing trades. These fees can vary based on the exchange and the type of order. Market orders often have higher fees compared to limit orders.

- Trading Fees: Typically a percentage of the transaction amount, which can range from 0.1% to 0.5% or more, depending on the exchange.

- Withdrawal Fees: Additional fees may apply when withdrawing fiat currency to your bank account. These fees can be fixed or a percentage of the withdrawal amount.

- Deposit Limits: Some exchanges impose limits on the amount of cryptocurrency you can deposit in a given period. These limits can depend on your verification level.

- Withdrawal Limits: There are also limits on the amount of fiat currency you can withdraw to your bank account. Higher verification levels on the exchange can increase these limits.

- Minimum Order Amounts: Exchanges often have minimum order amounts for both buy and sell orders. Ensure your sell order meets the exchange’s minimum requirements.

Withdrawing Fiat to Your Bank Account

Initiating a Bank Transfer

To withdraw fiat currency from your exchange account to your bank account, follow these steps:

- Log In to Your Exchange Account: Access your account on the cryptocurrency exchange where your fiat currency is held.

- Navigate to the Withdrawal Section: Go to the section of the exchange designated for withdrawals, often labeled as “Withdraw,” “Funds,” or “Bank Transfer.”

- Select Fiat Currency: Choose the fiat currency you wish to withdraw (e.g., USD, EUR).

- Enter Withdrawal Amount: Specify the amount of fiat currency you want to transfer to your bank account. Make sure to consider any minimum withdrawal limits and fees.

- Select Bank Account: Choose the bank account you have previously linked and verified on the exchange. If you haven’t linked your bank account yet, follow the exchange’s instructions to add and verify your bank account details.

- Review Withdrawal Details: Double-check the withdrawal amount, fees, and bank account information to ensure accuracy.

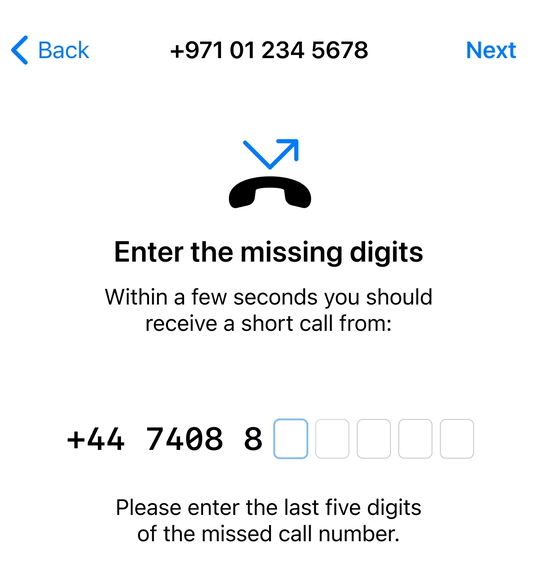

- Initiate the Transfer: Confirm and submit your withdrawal request. You may need to enter a verification code sent to your email or phone for security purposes.

Expected Processing Times and Potential Delays

Understanding the processing times and potential delays for fiat withdrawals is important for planning:

- Processing Times: The time it takes for the withdrawal to reach your bank account can vary depending on the exchange and your bank. Typically, processing times range from 1 to 5 business days.

- Instant Withdrawals: Some exchanges offer instant withdrawal options, but these may come with higher fees.

- Standard Withdrawals: Standard withdrawals generally take longer but may have lower fees.

- Potential Delays: Several factors can cause delays in processing your withdrawal:

- Bank Processing Times: Your bank’s processing times can affect how quickly you receive the funds. Some banks may take longer to process incoming transfers.

- Exchange Processing Times: The exchange itself may require additional time to process and approve large or first-time withdrawals.

- Verification Delays: If your bank account or identity verification is incomplete or flagged for review, this can delay the withdrawal process.

- Bank Holidays and Weekends: Withdrawals initiated on weekends or bank holidays may take longer to process as banks typically operate only on business days.

- Compliance Checks: Large transactions may be subject to additional compliance checks and regulatory approvals, which can cause delays.

Ensuring Security and Compliance

Best Practices for Secure Transactions

To ensure the security of your transactions when converting cryptocurrencies to fiat and transferring them to your bank account, follow these best practices:

- Use Strong Passwords: Ensure that your exchange account is protected by a strong, unique password. Consider using a password manager to generate and store complex passwords.

- Enable Two-Factor Authentication (2FA): Activate 2FA on your exchange account to add an extra layer of security. Use an authenticator app like Google Authenticator or Authy rather than SMS-based 2FA.

- Regularly Monitor Account Activity: Keep an eye on your exchange account for any suspicious activity. Immediately report any unauthorized transactions or access to the exchange’s support team.

- Secure Your Recovery Phrases: If you’re using Trust Wallet or other wallets, securely store your recovery phrases offline. Never share them with anyone and avoid storing them digitally.

- Use Reputable Exchanges: Only use well-known and reputable exchanges with strong security measures and positive user reviews.

- Beware of Phishing Scams: Be cautious of emails, messages, or websites that ask for your account details or private keys. Always access your exchange account directly through its official website or app.

- Regular Software Updates: Keep your exchange app and Trust Wallet app updated to the latest versions to benefit from security patches and new features.

Understanding Tax Implications and Legal Compliance

Converting cryptocurrencies to fiat and transferring funds to your bank account has tax and legal implications. It’s important to understand and comply with these requirements:

- Tax Reporting: Cryptocurrency transactions, including conversions to fiat, may be taxable events. Keep detailed records of your transactions, including dates, amounts, and values at the time of the transactions.

- Capital Gains Tax: You may be liable for capital gains tax on any profits made from selling cryptocurrencies. The tax rate can vary depending on your jurisdiction and the length of time you held the assets.

- Income Tax: If you receive cryptocurrency as income (e.g., mining, staking, or payment for services), it may be subject to income tax.

- Consult a Tax Professional: Due to the complexity of cryptocurrency taxation, it’s advisable to consult with a tax professional who is familiar with digital asset regulations in your country.

- Compliance with Regulations: Ensure that you comply with any anti-money laundering (AML) and know your customer (KYC) regulations required by your jurisdiction. This may involve verifying your identity with exchanges and reporting large transactions.

- Legal Considerations: Stay informed about the legal status of cryptocurrencies in your country. Some countries have specific regulations regarding cryptocurrency transactions, trading, and taxation.

- Reporting Requirements: Some jurisdictions require the reporting of foreign financial accounts, including cryptocurrency holdings on international exchanges. Ensure you understand and comply with these requirements.